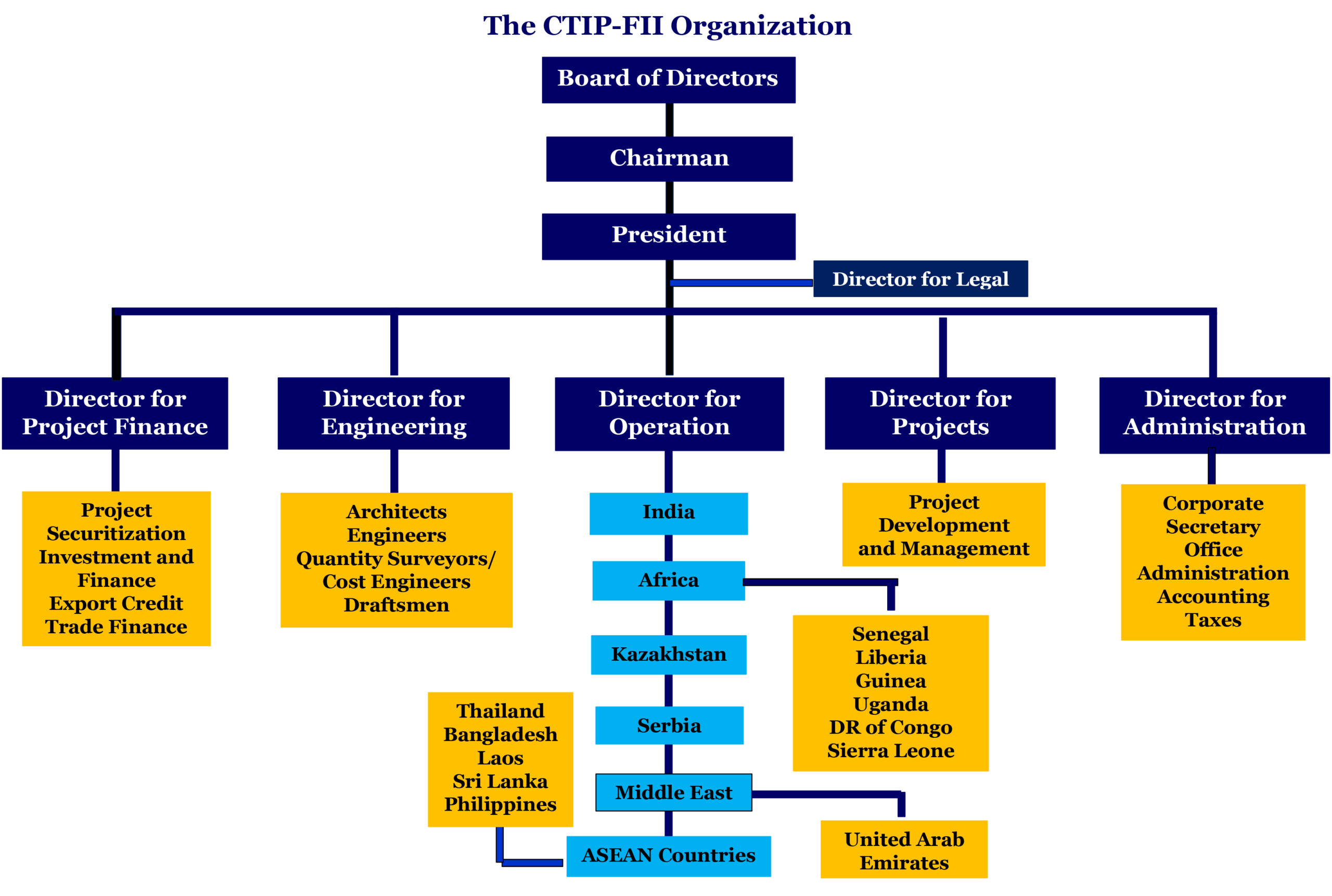

Who we are

FERNANDO M. SOPOT, President, Founder and Charter President of CTIP and President of the other affiliate companies of CTIP.

He is an Agricultural Engineer by Profession, an MBA, Major in Management, and graduate of Bachelor of Laws, LLB. He has been involved in Farm Machinery business for 10 Years, more than 5 Years in Banking and Finance and more than 25 Years in Construction and Development. He is a lecturer on PPP, International Trade and Finance. Have undertaken several trainings on export credit, public and private finance, and resource speaker of various event organizers of international Forums, conferences, and Seminars. More than two decades of experience in project development and project finance.

Mr. EMMANUEL OLUWEHUJE, Director for Operation for CTIP- FII.

An international business and investment leader, multilinguist, philanthropist and specializing on business in Africa. Likewise, he has proven experience in project management and development in many developing countries. Moreover, he is very well experienced in the development of renewable and non-renewable energy projects. An associate of US Capital LLC, and President & CEO of African Alternative Investment Group and President of Africa Infrastructure and Development, Inc.

JEFFERY JONES, BS, MA, Chairman, Co-Founder of CTIP and its affiliate companies.

Over 20+ years Chief Executive (Former Mayor of the City of Paterson, NJ) and Legislator; 20 years Non-Profit Trainer and Entrepreneur developer; 15 years lecturer in Higher Education; 7 years Systems Programmers.

CHRISTOPHE SCHWOERTZIG, Director for Project Finance for CTIP-FII.

CEO and Financial Director regulated by the MFSA, fundraising, and strategy consulting services. Founder of Value Creation Alternative, with more than 2,000 international members. An MBA, General Management at IESE Business School, and MBA, Strategy and Finance, London Business School and Master of Engineering – Meng. Information, Insa De Lyon. Decades of experience in project finance and many more.

Manuel Urbano, Director of Media at CTIP-FII.

He is an experienced creative professional adept in photography, digital filmmaking, teaching, and web development. Proficient in a range of software for photography, video editing, web design, and graphic design. Skilled ESL instructor with fluency in English and Spanish, Website developer, Photographer and Film Director.

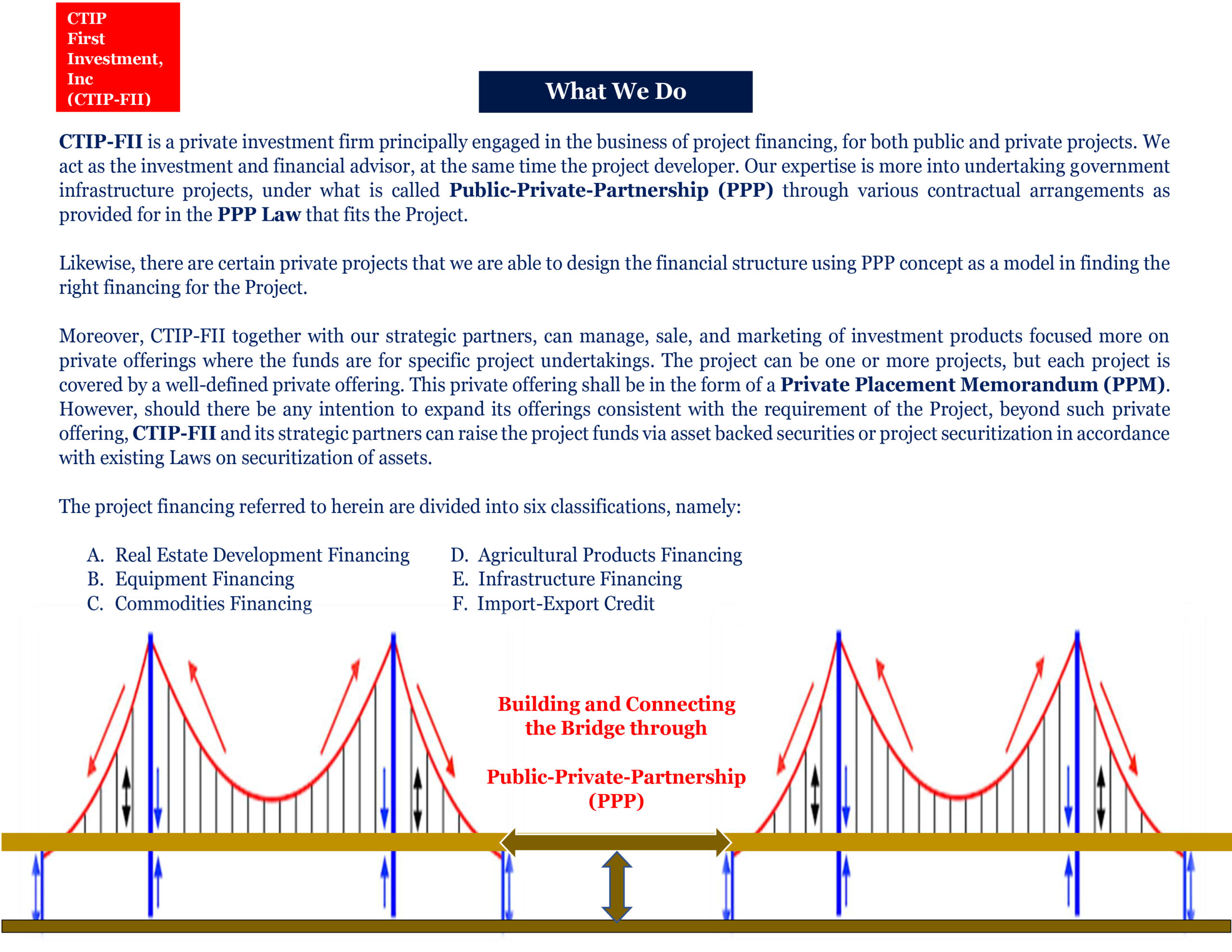

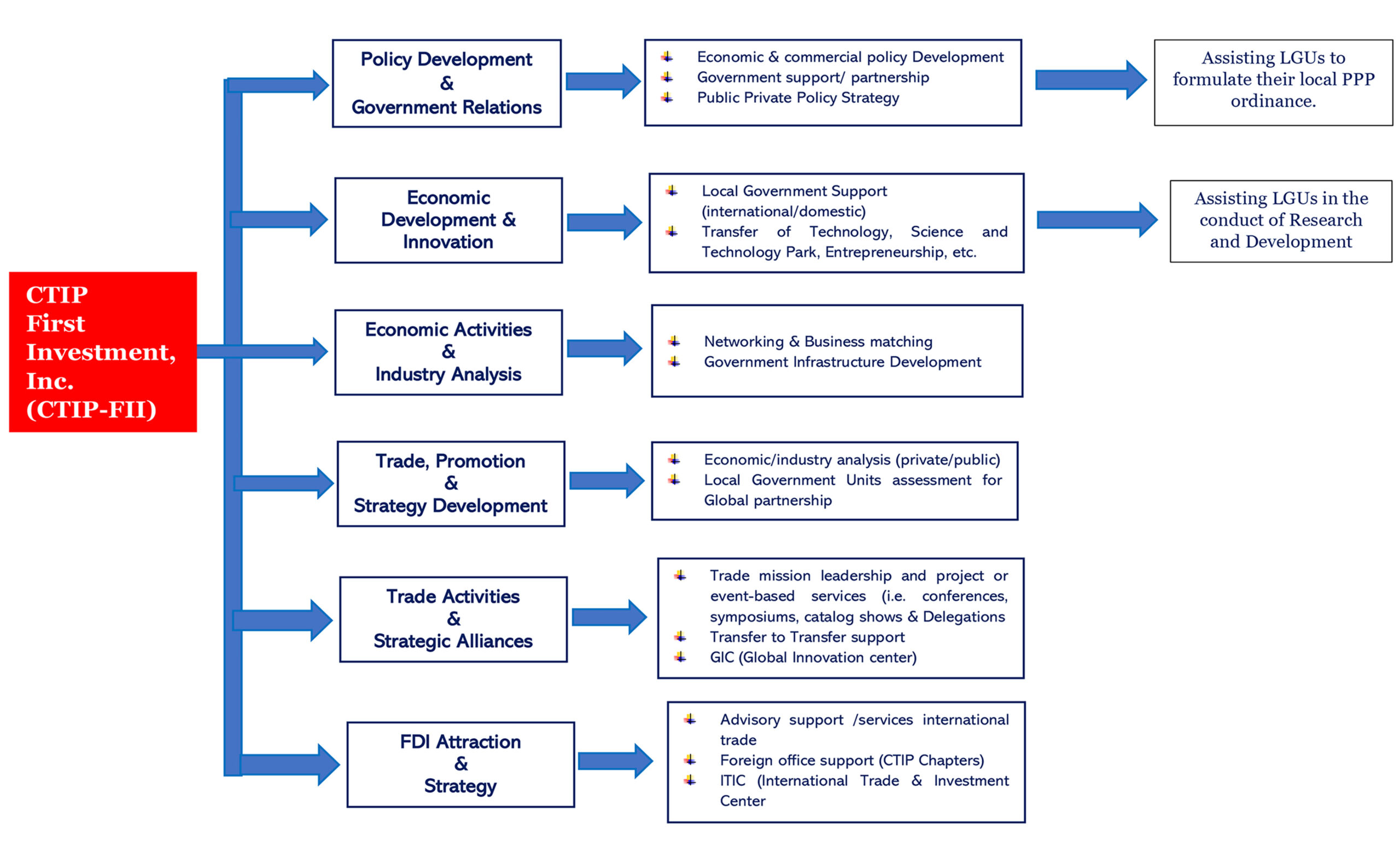

What we do

Supporting Government Capacity Build-Up

Defining Public-Private-Partnership

Public-Private Partnership (PPP) can be broadly defined as a contractual agreement between the Government and a private firm targeted towards financing, designing, implementing, and operating infrastructure facilities and services that were traditionally provided by the public sector. It embodies optimal risk allocation between the parties – minimizing cost while realizing project developmental objectives. Thus, the project is to be structured in such a way that the private sector gets a reasonable rate of return on its investment.

PPP offers monetary and non-monetary advantages for the public sector. It addresses the limited funding resources for local infrastructure or development projects of the public sector thereby allowing the allocation of public funds for other local priorities. It is a mechanism to distribute project risks to both public and private sector. PPP is geared for both sectors to gain improved efficiency and project implementation processes in delivering services to the public. Most importantly, PPP emphasizes Value for Money – focusing on reduced costs, better risk allocation, faster implementation, improved services, and possible generation of additional revenue.

Public-Private-Partnership – The Future on Public Construction

Public-Private-Partnership (PPP)

PPP is a mode or a concept, subject to different contractual arrangements entered by the Government with the Private Sector. Under the PPP Mode, the private sector can enter into different contractual arrangements with the Government subject to a mutually acceptable terms and conditions.

CTIP FII – Strategic Partners

USA and International

Our Projects

USA and International

CTIP-FII makes its profits by buying and selling of properties, shares, bonds, cash, other funds and other assets.

Council for Trade and Investment Promotion – First Investment, Inc.

Definition of Terms:

Investment Firm

An investment firm is a corporation, or a trust engaged in the business of investing the pooled capital of investors in financial securities. In the case of CTIP-FII, the funds raised are for directional use or for a specific Project or Projects where the member companies of CTIP are involved.

An investment company is also known as “fund company or fund sponsor”. CTIP-FII is a fund sponsor. In most cases, CTIP-FII often partner with Third-Party Investors and with strategic distributors to sell securities, either through private or public offering in accordance with US Securities Laws.

CTIP-FII makes its profits by buying and selling of properties, shares, bonds, cash, other funds and other assets.

What is Globalization?

Globalization is the spread of products, technology, information, and jobs across national borders and cultures.

In economic terms, it describes an interdependence of nations around the globe fostered through free trade.

It can raise the standard of living in poor and less developed countries by providing job opportunity, modernization, and improved access to goods and services.

The Private Offering Exemption – Private Placement Memorandum (PPM)

Section 4(2) of the Securities Act exempts from the registration and prospectus delivery requirements of Section 5 any “transactions by an issuer not involving a public offering. The exemption established by Section 4(2) is often referred to as the “private offering” or “private Placement” exemption.

The statutory private offering exemption is self-executing that no notice or other filings or regulatory approvals are required as a condition to the effectiveness of the exemption.

We will never reach TRUE SUCCESS, unless we help others become successful.

CTIP-FII ADVOCACY: Supporting Local Government Capacity Build Up

Public-Private-Partnership

The Future on Public Construction

Security

Any note, stock, treasury stock, bond, debenture, evidence of indebtedness, certificate of interest or participation in any profit sharing agreement, collateral-trust-certificate, preorganization certificate or subscription, transferable share, investment contract, voting trust certificate, certificate of deposit for a security, fractional undivided interest in oil, gas, or other mineral rights, any put, call, straddle, option, or privilege on any security (including a certificate of deposit) or on any group or index of securities (including any interest therein or based on the value thereof), or any put, call straddle, option, or privilege entered into on a national securities exchange relating to foreign currency, or, in general, any interest or instrument commonly known as “security,” or any certificate of interest or participation in, temporary or interim certificate for, guarantee of, or warrant or right to subscribe to or purchase, any of the foregoing.”

What is the role of a Fund Manager?

A Fund Manager is responsible for implementing a fund’s investing strategy and managing its portfolio trading activities. The Fund can be managed by one person, by two people as co-managers, or by a stream of three or more people.

Fund Managers are paid a fee for their work, which is a percentage of the fund’s average assets under management (AUM). They can be found working in fund management with mutual funds, pension funds, trust funds, and hedge funds. Investors should fully review the investment style of fund managers before they consider investing in a fund.

Public-Private-Partnership (PPP)

PPP is a mode or a concept, subject to different contractual arrangements entered by the Government with the Private Sector. Under the PPP Mode, the private sector can enter into different contractual arrangements with the Government subject to a mutually acceptable terms and conditions, such as but not limited to: Build-Operateand-Transfer (BOT), including maintenance of the Public Infrastructure Facilities and provide services traditionally delivered by Government.