CTIP – First Investment Inc.

Some of the On-Going Projects of CTIP-FII in its capacity as the Project Developer and Investment and Finance Advisor for the Project.

Partial list of Projects and activities being pursued

For the Year 2022

Africa

CTIP-FII’s Directors for Business Development

Countries

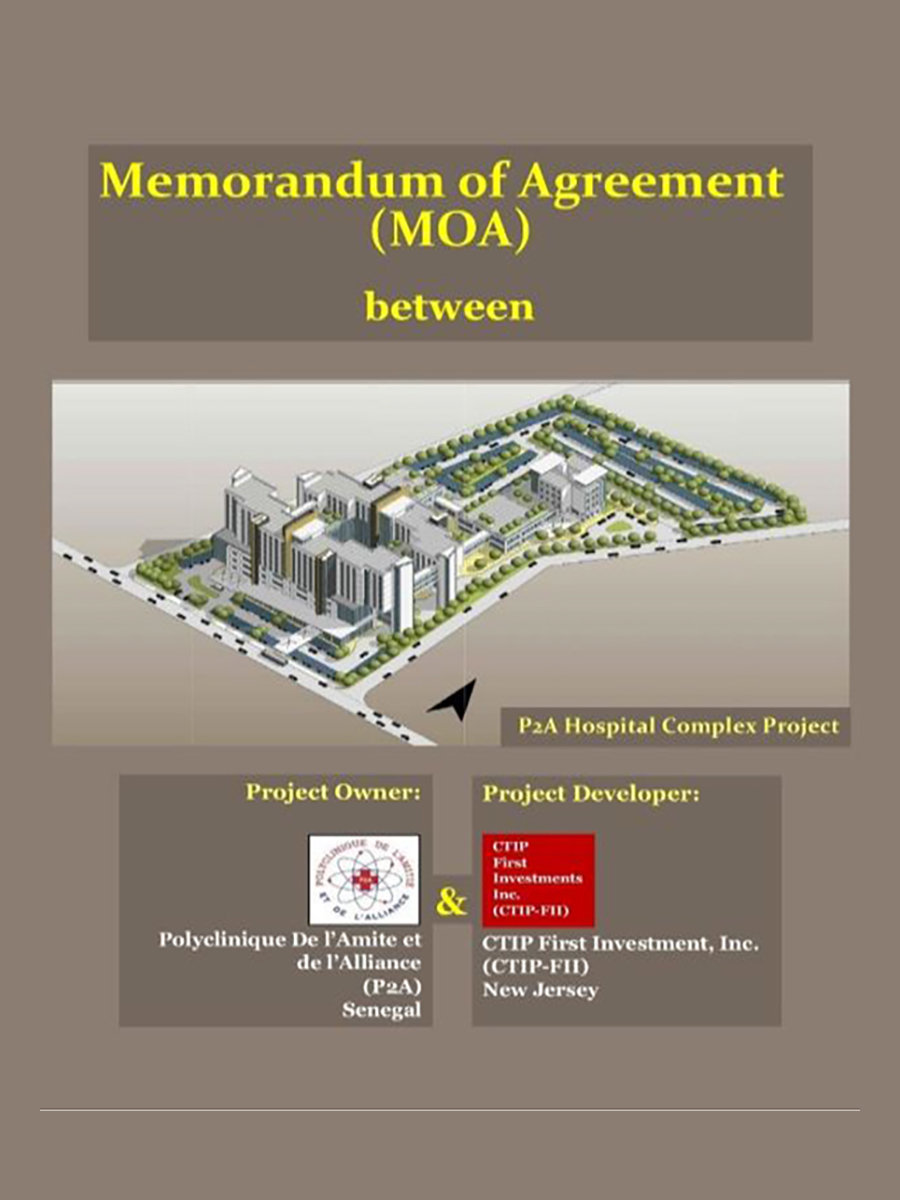

Senegal

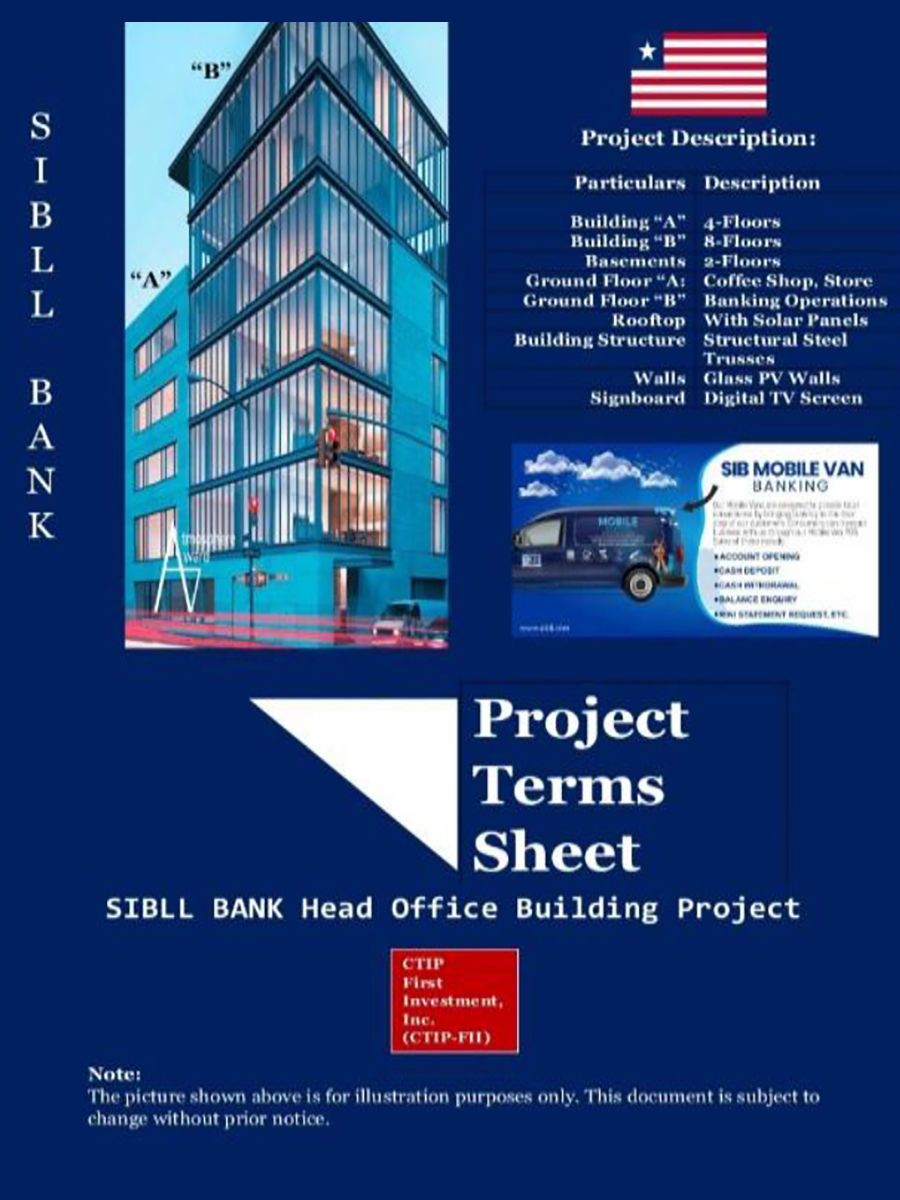

Liberia

Uganda

Guinea

Gambia

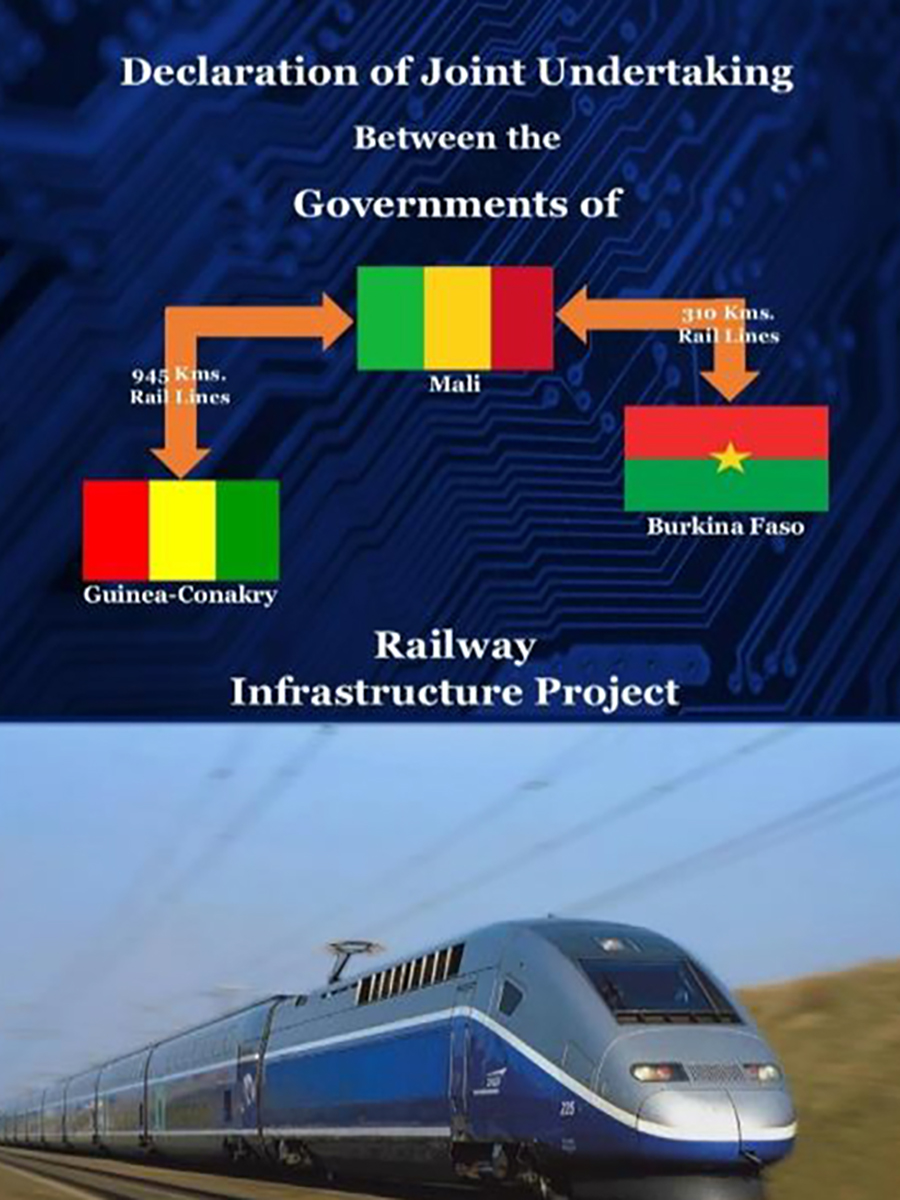

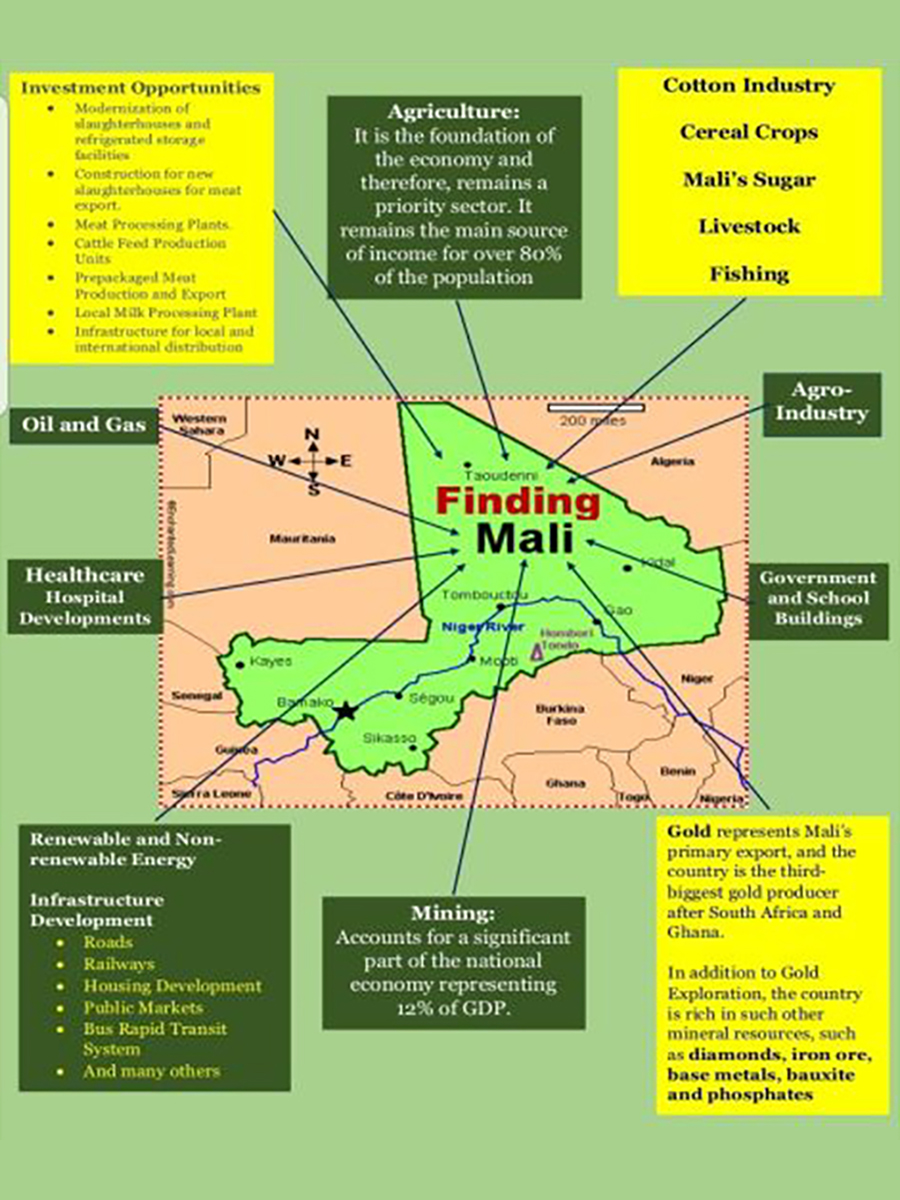

Mali

Nigeria

Ghana

Sierra Leone

Ivory Coast

D.R. of Congo

Morocco

The success of the political leadership depends on compliance of what they promised to their electorate once they are elected.

CTIP-FII is a private investment firm principally engaged in the business of project financing, for both public and private projects.

CTIP First Investment, Inc. or CTIP-FII has become known to many companies involved in infrastructure development or landowners or project owners, as a company that they can rely on when it comes to project development and designing the right financial structure that fits their envisioned projects. These landowners want to develop their non- performing assets into performing assets. And many Local Government Units (LGUs) in some developing countries have seek CTIP-FII advice on how well they can move forward with their planned infrastructure development under what is popularly called Public-Private-Partnership (PPP).

PPP maybe popular, but the intricacies of undertaking a PPP Project is still not known to LGUs of most if not all developing countries. This is because the enactment of there PPP Law is usually on a national level, and maybe due to lack of information and understanding of the Law, many LGUs relies on dole-outs from their politicians or from there national governments.

The absence of a PPP Ordinance in the LGU level that is responsive to the needs of their constituents without deviating from the intents and purposes upon which the PPP Law was enacted on a national level could be the missing link in providing infrastructure facilities to their Municipalities or Cities, in the name of public service.

Our Rivercess County Community Hospital Project in Liberia is a case in point. The County and the Minister of Health and Social Services, have both realizes that an LGU can be a focal point of development or a project originator, without the Ministry dictating on them what is good for their County. This is a model worthy of emulation, where the Ministry’s role is to guide the County and help supervise the development of the Hospital Project. The responsibility on the PPP implementation is left in the hands of the local leaders.

CTIP-FII has won the hearts of the County Officials and the Ministry of Health. The importance of the PPP Law is being felt in the County, while on the other hand, success in completing the Project and make it operational for the citizenry has become a foreseeable future.

CTIP-FII therefore is strong in project development and designing the right financial structure for the Project. Not all Projects are alike. Therefore, that goes also to the type of contractual arrangements under PPP, and the right financing for the Project that can be introduced in the Project.

PPP is a mode, a concept, a methodology that can be used by LGUs when time comes there is budget limitations in developing infrastructure projects in providing a quality and efficient public service. There are many contractual arrangements that can be used to choose from to fit a specific infrastructure project. There are modalities like BOT, BT, BTO, BLT, and many more that CTIP-FII can recommend to an LGU.

The success of the political leadership depends on compliance of what they promised to their electorate once they are elected.

CTIP-FII Public-Private-Partnership (PPP) Services

Defining Public-Private-Partnership

Public-Private Partnership (PPP) can be broadly defined as a contractual agreement between the Government and a private firm targeted towards financing, designing, implementing, and operating infrastructure facilities and services that were traditionally provided by the public sector. It embodies optimal risk allocation between the parties – minimizing cost while realizing project developmental objectives. Thus, the project is to be structured in such a way that the private sector gets a reasonable rate of return on its investment.

PPP offers monetary and non-monetary advantages for the public sector. It addresses the limited funding resources for local infrastructure or development projects of the public sector thereby allowing the allocation of public funds for other local priorities. It is a mechanism to distribute project risks to both public and private sector. PPP is geared for both sectors to gain improved efficiency and project implementation processes in delivering services to the public. Most importantly, PPP emphasizes Value for Money – focusing on reduced costs, better risk allocation, faster implementation, improved services, and possible generation of additional revenue.

Council for Trade and Investment Promotion – First Investment, Inc.

Definition of Terms:

Investment Firm

An investment firm is a corporation, or a trust engaged in the business of investing the pooled capital of investors in financial securities. In the case of CTIP-FII, the funds raised are for directional use or for a specific Project or Projects where the member companies of CTIP are involved.

An investment company is also known as “fund company or fund sponsor”. CTIP-FII is a fund sponsor. In most cases, CTIP-FII often partner with Third-Party Investors and with strategic distributors to sell securities, either through private or public offering in accordance with US Securities Laws.

CTIP-FII makes its profits by buying and selling of properties, shares, bonds, cash, other funds and other assets.

What is Globalization?

Globalization is the spread of products, technology, information, and jobs across national borders and cultures.

In economic terms, it describes an interdependence of nations around the globe fostered through free trade.

It can raise the standard of living in poor and less developed countries by providing job opportunity, modernization, and improved access to goods and services.

The Private Offering Exemption – Private Placement Memorandum (PPM)

Section 4(2) of the Securities Act exempts from the registration and prospectus delivery requirements of Section 5 any “transactions by an issuer not involving a public offering. The exemption established by Section 4(2) is often referred to as the “private offering” or “private Placement” exemption.

The statutory private offering exemption is self-executing that no notice or other filings or regulatory approvals are required as a condition to the effectiveness of the exemption.

We will never reach TRUE SUCCESS, unless we help others become successful.

CTIP-FII ADVOCACY: Supporting Local Government Capacity Build Up

Public-Private-Partnership

The Future on Public Construction

Security

Any note, stock, treasury stock, bond, debenture, evidence of indebtedness, certificate of interest or participation in any profit sharing agreement, collateral-trust-certificate, preorganization certificate or subscription, transferable share, investment contract, voting trust certificate, certificate of deposit for a security, fractional undivided interest in oil, gas, or other mineral rights, any put, call, straddle, option, or privilege on any security (including a certificate of deposit) or on any group or index of securities (including any interest therein or based on the value thereof), or any put, call straddle, option, or privilege entered into on a national securities exchange relating to foreign currency, or, in general, any interest or instrument commonly known as “security,” or any certificate of interest or participation in, temporary or interim certificate for, guarantee of, or warrant or right to subscribe to or purchase, any of the foregoing.”

What is the role of a Fund Manager?

A Fund Manager is responsible for implementing a fund’s investing strategy and managing its portfolio trading activities. The Fund can be managed by one person, by two people as co-managers, or by a stream of three or more people.

Fund Managers are paid a fee for their work, which is a percentage of the fund’s average assets under management (AUM). They can be found working in fund management with mutual funds, pension funds, trust funds, and hedge funds. Investors should fully review the investment style of fund managers before they consider investing in a fund.

Public-Private-Partnership (PPP)

PPP is a mode or a concept, subject to different contractual arrangements entered by the Government with the Private Sector. Under the PPP Mode, the private sector can enter into different contractual arrangements with the Government subject to a mutually acceptable terms and conditions, such as but not limited to: Build-Operateand-Transfer (BOT), including maintenance of the Public Infrastructure Facilities and provide services traditionally delivered by Government.

Strategic Partners, Clients and Other

Projects and activities of CTIP-FII

Building and Connecting the Bridge through

Public-Private-Partnership

(PPP)