“A Compilation of Guidelines in

Real Estate Development and Development Loans”

NOTE:

This CTIP-FII document is simply a compilation of informati on regarding Guidelines in Real Estate Development and Development Loans, especially for private project development undertaking.

The purpose of which is to guide our Business Developme nt Officers in their respective areas of operation to be more circumspect and be prepared to evaluate deals offered to them with the end in view that the project can be bankable.

It is also important to consider the fact that the securities or collateral offered when going into borrowi ngs, must be something acceptable to our lender/partners.

This d ocument is subject to change without prior notice.

Most people believe you need a ton of cash in the bank to become a real estate developer.

The truth is that you can obtain financing for a development project, but a conventional mortgage won’t suffice.

Instead, you can get a real estate development loan, which can be used to finance construction projects and other related expenses.

Here is a closer look at property development loans and how to obtain one. What Are Real Estate Development Loans?

Real estate development loans are a type of loan used to finance the purchase and development of a property, including everything from land acquisition to construction.

There are several different types of real estate development loans that can finance different parts of the process. For instance, some developers may need financing for the land purchase or construction, while others may need to finance the entire project up to the final sale or leasing. Types of Real Estate Development Loans

1. Acquisition Loans

2. Land Development Loans

3. Acquisition Development Loans

4. Construction Loans

1. Acquisition Loans Acquisition loans are used solely to finance the acquisition of a piece of land. Many developers purchase land, intending to sit on it for years before developing it. They may be waiting for specific zoning changes or haven’t decided what they will do with the property but don’t want to lose it. In that case, an acquisition loan would help pay for the lot and could be paired with an additional loan down the line when necessary.

2. Land Development Loans Land development loans are used to finance the improvement of a piece of land. This is the next logical step in the development process, and borrowers can use the funds for things like tearing down existing construction, laying pipes, building infrastructure and roads, and setting up a construction site.

3. Acquisition Development Loans Acquisition development loans are a combination of acquisition loans and land development loans. You can use an acquisition development loan to finance both steps, purchasing the land and developing it. That way, you can begin the development process as soon as you receive the title.

4. Construction Loans Construction loans finance the creation or renovation of buildings and structures. So, once you’re ready to break ground and start putting up walls, you’ll need a construction loan. Unlike development and acquisition loans, construction loans are dispersed as a monthly payment rather than a lump sum, increasing as the process moves along.

How to Get a Development Loan

1. Develop a Track Record

2. Create a Plan

3. Research Your Target Market

4. Create a Pro Forma

5. Work On Your Pitch

6. Identify Target Lenders

7. Give Your Pitch

1. Develop a Track Record Real estate development isn’t easy and often requires a significant investment. So, no lender will take you seriously without a previous track record of success. That doesn’t necessarily have to be development experience, but having experience owning a business or investing in real estate will help your chances of getting approved. If you don’t have any experience, you may decide to bring on an experienced partner to enhance your creditability.

2. Create a Plan Next, you’ll want to create a detailed plan for your development project. Your plan should include where you plan to build, why you’re targeting that location, what kind of property you will construct, and how long you plan on working on the project. It should also include a brief construction timeline, what you plan to do when the project is complete, and any other relevant details. The more detailed and thorough your plan, the easier it will be to find a lender.

3. Research Your Target Market You’ll also want to do in-depth research on the target market and conduct a study to prove why your project will succeed. It may take you several years to complete the construction, so you’ll want to be sure that there will still be a demand for what you’re building when you finish. You should study everything you can, including demographics, housing prices, population trends, employment data, zoning laws, and anything else you think may be relevant to the success of your project.

4. Create a Pro Forma A proforma calculates an investment’s financial results to show the potential cash flow and ROI of a property. Lenders will want to see a pro forma to ensure that the numbers make sense, and you understand the related costs. It should include the projected fees of the development, including land acquisition, construction, management, and overhead, as well as the projected revenue determined by the sale or rental of each unit. Creating a solid pro forma backed by facts will go a long way toward convincing a lender to believe in your vision.

5. Work on Your Pitch Once you’ve done your research and collected all the necessary data, it’s time to work on your pitch. You’ll want to be able to quickly and eloquently explain your project to get them interested and be willing to even look at the numbers. You may have a great idea but still struggle to find a lender who will take you seriously if you can’t sell your vision. You don’t have to get too detailed or extravagant; just focus on what you’re trying to build and why it’s necessary to improve the community. If you can do that well and provide the research to back it up, you shouldn’t have trouble getting a loan.

6. Identify Target Lenders After you’ve perfected your pitch, it’s time to decide who you will target with the pitch. You can always get a development loan from a traditional lender like a bank or credit union. But they may have strict requirements that some developers may be able to meet, especially if they are first starting. So, you may instead pitch your idea to an angel investor or private lender if you know any high-net-worth individuals. Or, if you have connections in the financial world, you may try to pitch to a venture capital firm. Many different groups invest in real estate and offer construction loans, so you’ll need to decide what makes sense for your project.

7. Give Your Pitch Finally, you’ll want to approach potential lenders and give them your pitch. You may be approved immediately, or you may be rejected several times before you find an investor. But if you have a clean financial track record and a solid strategy backed by convincing data, you should find an investor eventually.

Tips For Getting a Development Loan

1. Educate Yourself in Financial Terms

2. Bring on Partners!

3. Work on Keeping Costs Low

4. Start Small

5. Pitch to Multiple Lenders

1. Educate Yourself in Financial Terms The more knowledgeable you are about the funding process, the more likely you’ll be approved for a loan. Lenders and business partners will want to see that you’ve done your research and have a plan for every step of the process. But you may lose their confidence if you don’t understand a particular term or statement. So, educating yourself on concepts like the capital stack, pro forma, cap rate, and any other real estate-related financial jargon will give you a leg up.

2. Bring on Partners Even seasoned real estate developers often bring on other partners to assume some of the responsibility and reduce their risk. So, if this is your first development project, it may be wise to bring on partners to lend their experience and creditability. It will not only help you reduce your own workload; it will also increase your chances of being approved for financing.

3. Work on Keeping Costs Low Lenders like to see healthy margins on a real estate project, especially if you’re new to the business. No matter how carefully you plan, there are always things that can go wrong that could result in delays and additional expenses. There is only so much profit you can realistically make on a project. But if you focus on keeping costs low, it increases the chances that the project will be a success, even if you experience unforeseen obstacles.

4. Start Small Real estate development is a challenging business that takes years to master fully. So, to increase your chances of success, start small and work your way up. If this is your first project, start with a modest single-family home or apartment building and work up to that multimillion-dollar hotel or shopping mall. The more experience you get under your belt, the easier it will be to obtain financing – so be patient.

5. Pitch to Multiple Lenders It’s always smart to shop around and find the best rates – even with a development loan. Chances are the value of the loan is quite high, which means any reduction in interest can result in thousands of dollars in savings over the life of the loan. Plus, if you get an offer from one lender, you may be able to use it to secure better terms with another lender if you’re clever. But either way, it never hurts to get a second opinion. Real Estate Development Loans Bottom Line Loans for property development are tougher to get than traditional mortgage loans, so you’ll need to make sure you prepare a solid pitch and approach multiple lenders. Whether you need an acquisition loan or a land development loan, the main thing is doing your homework. With the right connections and effort, you can find a development loan to finance any part of the process.

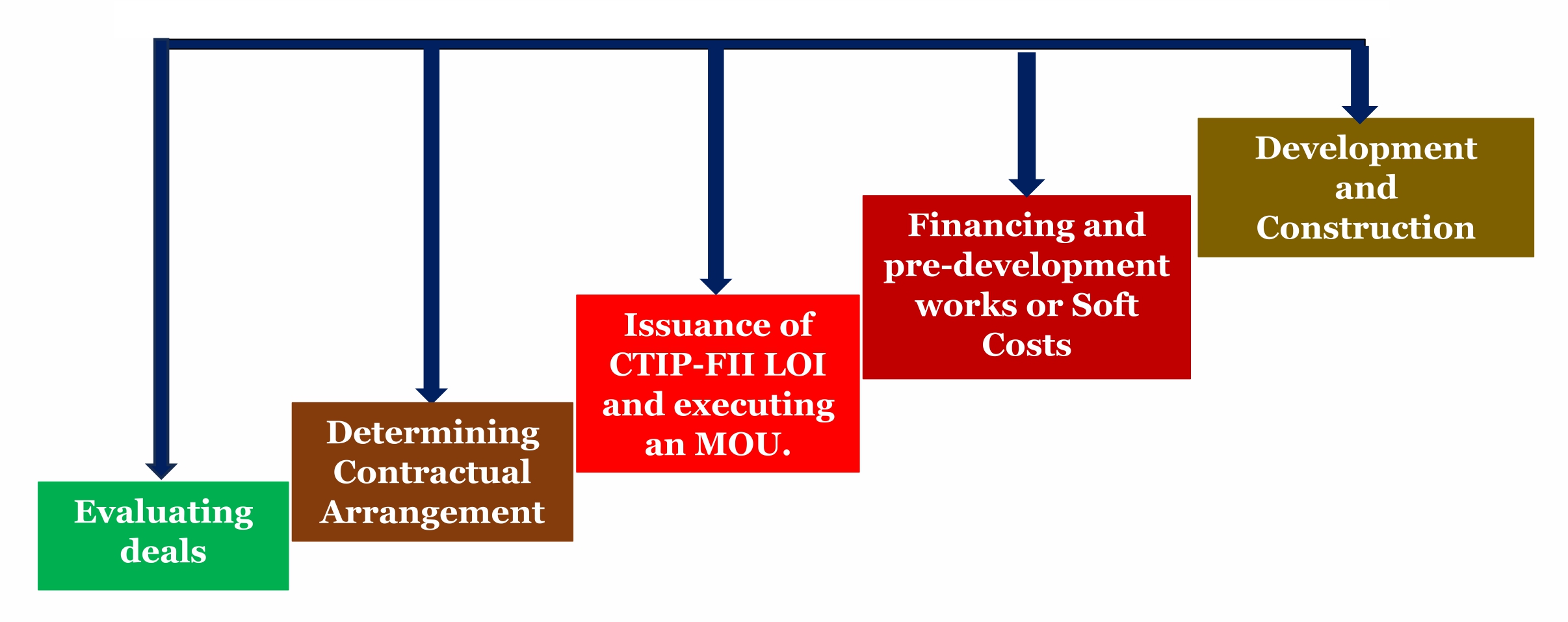

Flow Chart for development Undertakings:

– For illustration purposes only –

Project Title –

Senior Citizens Residence Project. (A 5-storey building with 44 residential units.)

Project Costs – $22 million

Location – 869 Clinton Avenue, Newark, NJ 07108, USA

Project Status – On-going.

Source of Funding –Combination of equity, debt and government grants and financing.

Private Project Information Form

Government Project Information Form